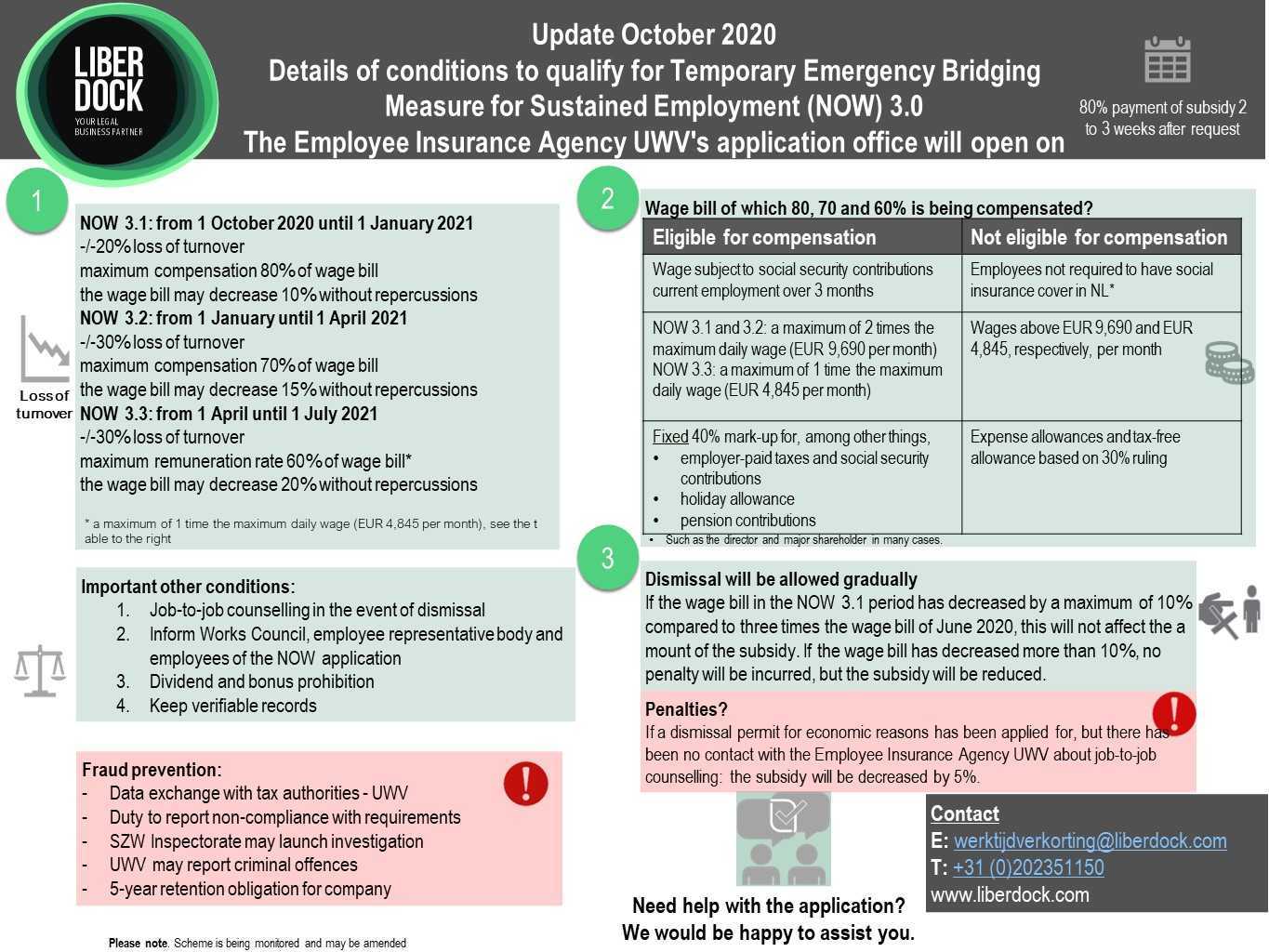

The third Temporary Emergency Bridging Measure for Sustained Employment (NOW, short for Dutch Noodmaatregel Overbrugging voor Werkgelegenheid) has entered into force. With effect from 16 November 2020, business owners with an expected loss of turnover of 20% may apply for subsidies with retroactive effect for the period between 1 October and 31 December 2020. This is followed by the second (1 January – 1 April 2021) and third (1 April – 1 July 2021) tranches of the NOW 3.0, which can be applied for separately.

The NOW 3.0 allows reorganisations and provides a more austere subsidy than its predecessors:

– A declining percentage (80–70–60%) of the subsidised wage bill.

– The maximum amount of wage that can be compensated per employee will be reduced with effect from 1 April.

– The threshold for the minimum loss of turnover will rise to 30% with effect from 1 January.

– The wage bill may decrease gradually (10-15-20%) without this adversely affecting the subsidy.

– The subsidy decrease for applying for dismissal permits on economic grounds ceases to apply.

– The employer is obliged to make an effort to provide job-to-job counselling for employees who have become redundant.

From 7 October 2020, employers can apply for NOW 1 to have their subsidy definitively determined.

Do you need help with the application or the determination of the definitive subsidy?

Contact

E: werktijdverkorting@liberdock.com

T: +31 202351 150

www.liberdock.com