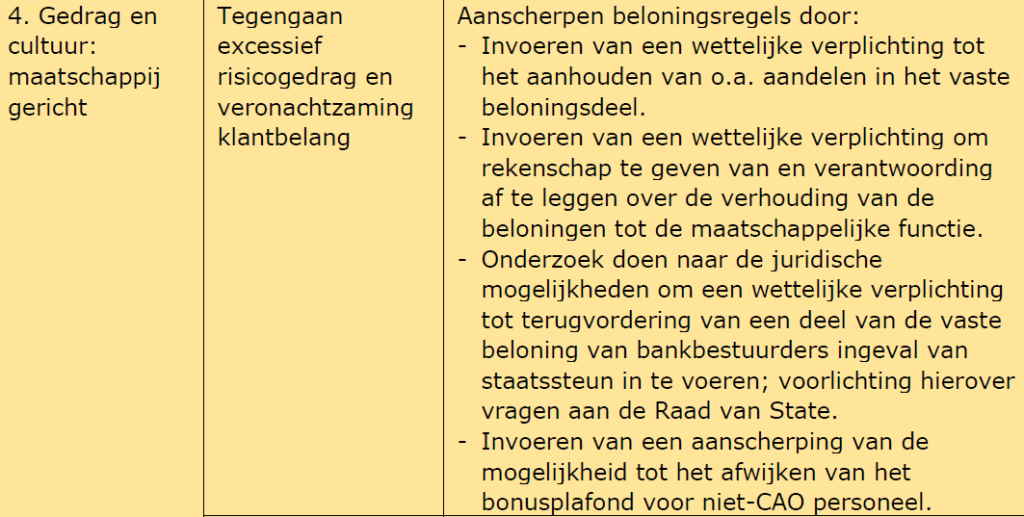

Earlier this year, proposals to increase the fixed remuneration of directors of banks and insurers caused indignation, particularly the proposed pay increase for Ralph Hamers at ING. The Minister believes this is detrimental to public support at a time when confidence in the sector needs to be regained. That is why the Minister is in the process of further tightening up the remuneration rules for the financial sector, which are already far-reaching.

In response to the proposed salary increases at ING earlier this year, the Minister will proceed, among other things, to tighten up the remuneration rules relating to fixed remuneration in the financial sector as follows:

- Introduction of a statutory obligation to hold shares and similar financial instruments in the fixed remuneration of directors and employees of financial undertaking for five years. The purpose of this measure is to bring the directors and employees’ interests more into line with the long-term interest of the undertaking and to contain the short-term risks.

- Introduction of a statutory obligation for financial undertakings to report on and account for the relationship between the remuneration and the undertaking’s function in the sector and its position in society. This measure, which includes stakeholder involvement, aims to increase public support for and confidence in the sector.

Furthermore, following the evaluation of the Dutch Financial Undertakings (Remuneration Policy) Act (Wbfo), the Minister will tighten up the possibility of deviating from the bonus ceiling for staff not subject to a collective labour agreement as follows:

- by making it explicit in the law that use is only possible in exceptional cases and in any event to exclude those who (i) perform internal monitoring duties and (ii) are directly involved in the provision of financial services to consumers;

- by introducing a statutory duty to notify the regulator about the use by the financial undertaking; and

- by explicitly including the use in the evaluation of the Wbfo in five years.

Additionally, the Minister is also considering the introduction of a statutory obligation to recover part of the fixed remuneration from the directors of systemically important banks in the event of state aid (claw back). The Advisory Division of the Council of State has been asked to provide information on the tenability under European law of such claw back. The Council of State is not expected to provide this information before the end of the first quarter of 2019.