A distinction must be made between 3 pension pillars:

1st pillar: Dutch State Pension (AOW).

2nd pillar: pension based on an agreement between the employer and employee. This pension is subject to the Dutch Pensions Act (PW). Membership of a mandatory industrial pension fund is also included in this pillar.

3rd pillar: all voluntary individual agreements, such as bank savings and annuities.

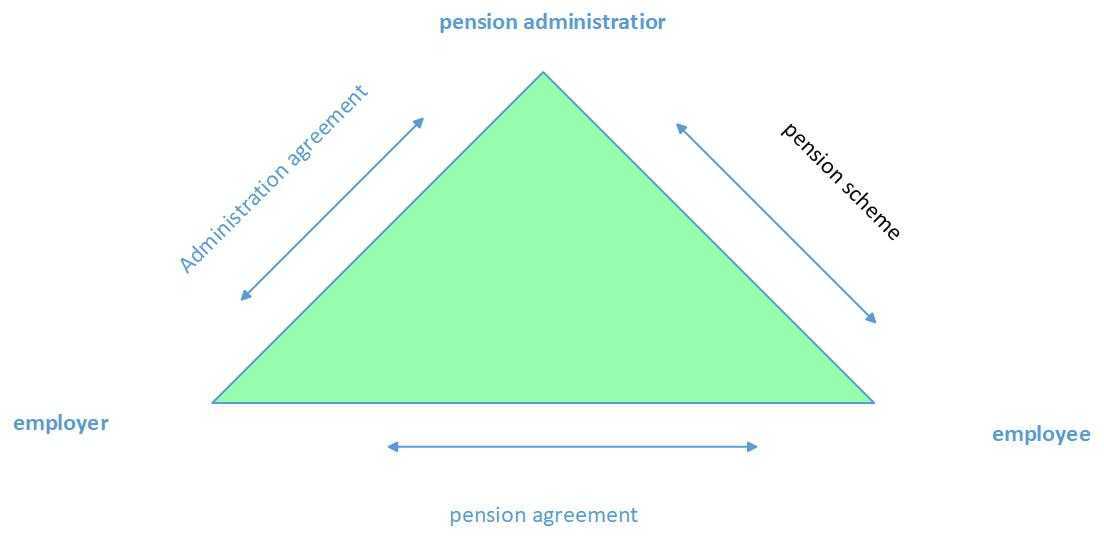

The figure below illustrates a 2nd pillar pension . The pension triangle can be illustrated as follows:

The employer is obliged to notify the employee in writing about possible membership of a pension scheme. Within one month after the employee starts work, the employer must notify the employee in writing regarding whether the employee will or will not be offered the opportunity to conclude a pension agreement and, if so, within which term the offer will be made and who the pension administrator will be.

Pursuant to the PW, an employer who fails to effect this notification will be considered to have made the employee an irrevocable offer to conclude a pension agreement if the employee belongs to the same group of employees to which the employer has indeed made an offer to conclude a pension agreement (deemed pension offer).

Substantive requirements of the PW

The pension agreement is not prescribed by regulation, although the PW does impose several substantive requirements. The employer may write out the pension agreement, but in practice the employment contract often refers to either the collective bargaining agreement in which the pension scheme is included or the applicable pension scheme (incorporation of the pension scheme).

Furthermore, the employer must ensure that, within 3 months, the employee with whom it has concluded a pension agreement and who is accruing pension entitlements is notified by the pension administrator (in the ‘start letter’) of the most important elements of pension scheme (Section 21 PW).

If an employer wishes to change the pension agreement for a group of employees, such change will be subject to the prior consent of the works council pursuant to Section 27 Dutch Works Council Act (WOR). Such consent is not required, however, in the case of mandatory membership of an industrial pension fund.

Changing a company pension scheme at individual level

Because the works council’s opinion is not binding on an individual employee, the employer will also have to change the pension agreement at individual level. The premise under the PW is that the pension agreement between an employer and an employee can only be changed if both parties agree, unless a unilateral change is justified based on Section 7:613/19 PW. Since a pension is an employment benefit, we therefore suggest that you refer to the explanation of unilateral changes to other statutory employment benefits.

Legal advice regarding pensions

Could you use some legal assistance with pension-law issues or with changing a company pension scheme? Please do not hesitate to contact us at +31202351150 or via the contact form. We would be glad to assist you.